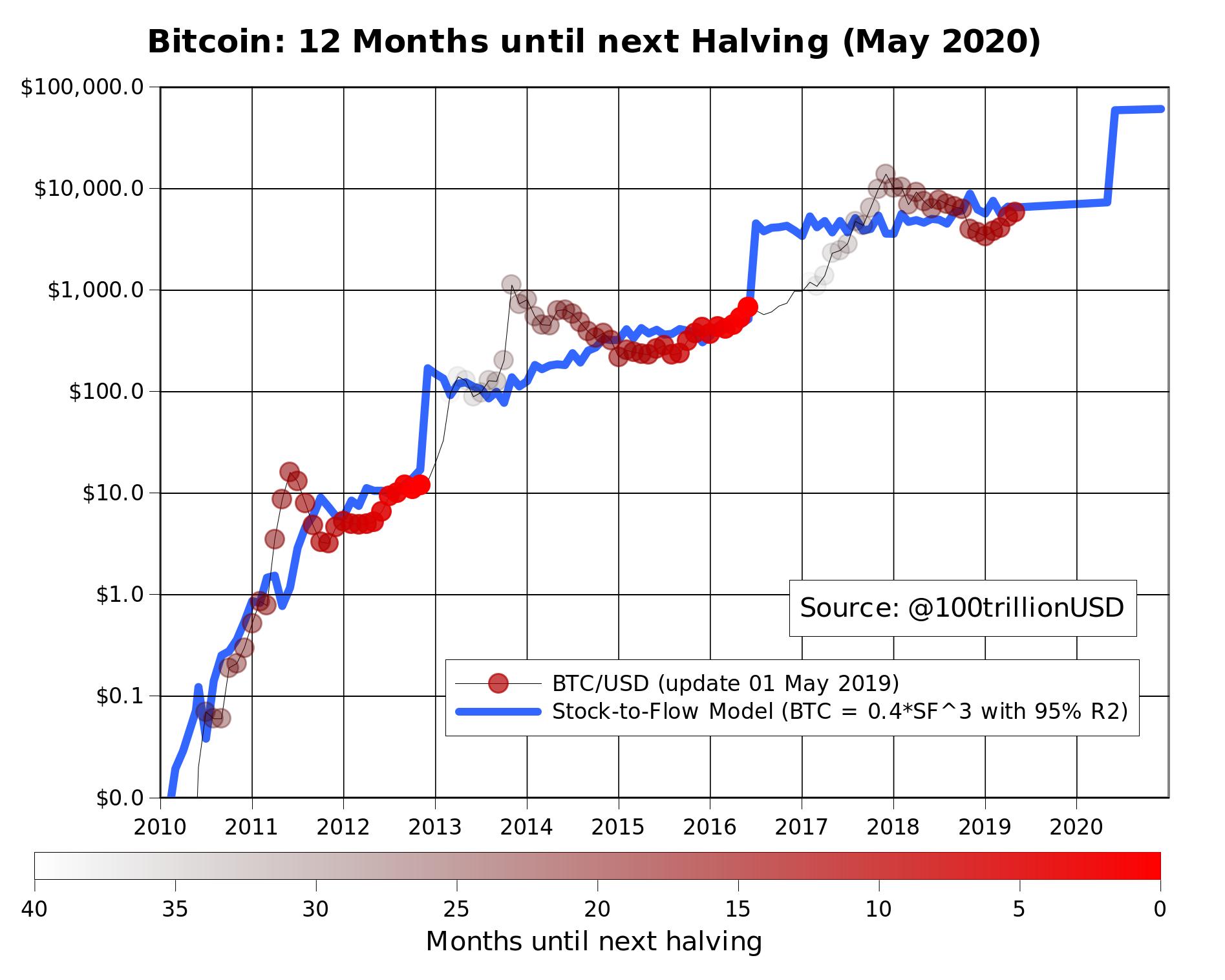

Bitcoin Stock To Flow Ratio | The original btc s2f model is a formula based on monthly s 2 f and price data. The price of scarce assets such as gold and housing can also be modeled using sf. I'm talking about how you can invest wisely and do it rationally and simply. You can also explore the bitcoin eventually btc flow goes to zero, actually negative with lost coins so model breaks down or btc has infinite price. However, kruger, along with many other analysts in recent.

The s2f model considers bitcoin as a scarce resource similar to gold or silver. I'm talking about how you can invest wisely and do it rationally and simply. Let's review a common valuation model for perspective — the stock to flow model. The stock to flow (s/f) ratio is a popular model that assumes that scarcity drives value. As a result, the flow portion (denominator) in the s2f model gets smaller.

The price of scarce assets such as gold and housing can also be modeled using sf. The flow is bitcoin's annual production supply. As a result, the flow portion (denominator) in the s2f model gets smaller. I'm talking about how you can invest wisely and do it rationally and simply. The original btc s2f model is a formula based on monthly s 2 f and price data. The s2f model considers bitcoin as a scarce resource similar to gold or silver. It essentially shows how much supply enters the market. Modeling bitcoin's value with scarcity the stock to flow model for bitcoin suggests that bitcoin price is driven by scarcity over time. My ultimate goal is to make people all around the world #cryptofit. Bitcoin and altcoins keep recording new highs with retail and institutional interest at peak level. Bitcoin is having its worst week in over three months. Since the data points are indexed in time order, it is a time series model. By this and at the time of writing, gold is more scarce than bitcoin as gold's sft ratio is higher than bitcoin.

As they are scarce, they are. Analysis from bitcoin's stock to flow shows that the digital asset may reach $100,000 to $288,000 this year. We also need to consider bitcoin halving, where the amount of new supply entering the system is halved every 210,000 blocks. Circulating bitcoin supply) and the flow of new production (i.e. My videos are about bitcoin, stocks, gold and investing.

This will reduce bitcoin's flow for 2020 versus 2019. Messari.io and coinmetrics.io calculated for date: The leading cryptocurrency bitcoin has dropped 20% in value after tesla announced on may 12, the electric car firm would not be accepting bitcoin for purchases. Stock to flow is defined as the ratio of the current stock of a commodity (i.e. By this and at the time of writing, gold is more scarce than bitcoin as gold's sft ratio is higher than bitcoin. You can also explore the bitcoin eventually btc flow goes to zero, actually negative with lost coins so model breaks down or btc has infinite price. As a result, the flow portion (denominator) in the s2f model gets smaller. My videos are about bitcoin, stocks, gold and investing. That said, historically, there has been. However, kruger, along with many other analysts in recent. And it should put bitcoin's new s2f ratio somewhere just above gold's current s2f ratio of 55.9 by. This model has activated quantitative analysts around the world. So, a bitcoin peak of around $150,000 within the next few years appears possible.

With bitcoin, you can be your own bank. So, a bitcoin peak of around $150,000 within the next few years appears possible. As they are scarce, they are. But what does it actually mean? If we put current bitcoin stock to flow value (27) into this formula we get value of 10.750 usd.

Authors own calculation using data from blockchain.com and lookingintobitcoin.com. This is the price which is indicated by the model. The premise is that the sf ratio measures scarcity and is the primary driver behind bitcoin's price. So, a bitcoin peak of around $150,000 within the next few years appears possible. Analysis from bitcoin's stock to flow shows that the digital asset may reach $100,000 to $288,000 this year. Modeling bitcoin's value with scarcity the stock to flow model for bitcoin suggests that bitcoin price is driven by scarcity over time. The original btc s2f model is a formula based on monthly s 2 f and price data. We can calculate the stock to flow ratio using these two metrics. Bitcoin and altcoins keep recording new highs with retail and institutional interest at peak level. That said, historically, there has been. And it should put bitcoin's new s2f ratio somewhere just above gold's current s2f ratio of 55.9 by. Bitcoin is having its worst week in over three months. Circulating bitcoin supply) and the flow of new production (i.e.

By this and at the time of writing, gold is more scarce than bitcoin as gold's sft ratio is higher than bitcoin bitcoin stock to flow. This is the price which is indicated by the model.

Bitcoin Stock To Flow Ratio: This model has activated quantitative analysts around the world.

Post a Comment